The forecast of an increase in the number of millennial workers has employers looking for innovative ways to keep their employees engaged. The problem is that many millennials are not interested in traditional corporate structures, which leaves companies scrambling for new measures.

The “plan vs actual analysis” is a plan-vs.-actual example. This blog post will show you how to do this.

Let’s have a look at how the plan vs. reality analysis works in practice.

For the record, the difference between plan and actual variation is referred to as variance in accounting and financial analysis. It’s a useful term to know. Furthermore, positive and negative variance, often known as good and bad variance, may exist.

Table of Contents

ToggleVariance that is positive:

- It ends up being a positive number.

- It’s great if you sell more than you anticipated. It’s also a plus if earnings exceed expectations. So, in terms of sales and profits, variation is the difference between actual and projected outcomes (subtract plan from actual).

- Spending less than anticipated on expenditures and expenses is a good thing, thus positive variation occurs when the actual amount is less than the planned amount. Subtract actual costs (or expenditures) from anticipated costs to arrive at a calculation.

Variance that is negative:

- The exact reverse is true. It’s terrible when sales or earnings fall short of expectations. By subtracting the plan from the reality, you may compute sales and profit variance.

- It’s also terrible when expenditures or expenses exceed expectations. You deduct the actual results from the expected outcomes once again.

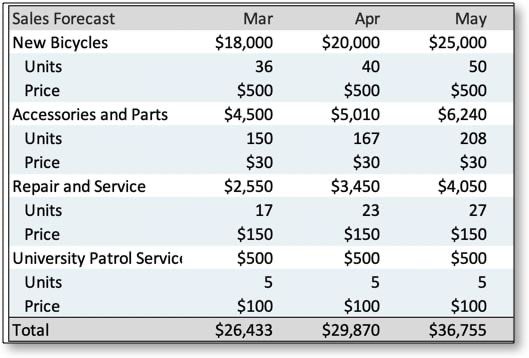

With a simple example, I’d want to demonstrate this. Let’s start with a basic sales strategy, then examine variation and determine what it implies. This is a basic sales prediction table from a typical sales forecast — only a part of it, displaying just three months.

Start-up Sales Strategy

To establish the picture, this diagram depicts three months of sales forecasting as the business plan nears completion.

Sales Results in Actual

The next graph depicts the real outcomes for the same business during the same three months as the previous graph.

Variance in Sales

The graph depicts the sales variation for the same months. The negative variances, or sales amounts fewer than you anticipated, are shown by the red figures.

It is the management that counts.

The variance analysis in this example should just be the start of a debate, not the final conclusion. Take, for example, new bicycle sales.

This company sold fewer units than expected (31 instead of 36), which seems to be a setback. On the other hand, the units they sold were more expensive than expected ($615 vs. $500). As a result, dollar sales were $1,053 more than expected ($19,053 vs. $18,000).

This is the point at which management starts. Pricing, marketing, promotions, and future forecasts are all affected by the disparity. Do they fear that by selling fewer units at greater prices, they would lose money? Is this a marketing or seasonal tendency for them? Or is it a successful shift in product mix to favor higher-priced bikes?

The question is what they will do next. The questions they should be asking are better framed with the assistance of variance analysis. And it gives you the knowledge you need to effectively respond or at the very least test potential answers.

A “planned vs actual formula” is a way to determine whether or not a plan will be successful. The “plan-vs.-actual formula” is used by businesses and organizations to compare the plan with the actual results.

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”What is the difference between actual and plan?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”A: Actual is the real price of an item, and plan is a savings that you will receive as long as you continue your subscription.”}},{“@type”:”Question”,”name”:”What is the difference between planned and actual performance?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:””}},{“@type”:”Question”,”name”:”What is the difference between planned and actual expenses?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”A: Planned expenses are those that you know about ahead of time. Actual expenses are the ones you spend on something, after planning it.”}}]}

Frequently Asked Questions

What is the difference between actual and plan?

A: Actual is the real price of an item, and plan is a savings that you will receive as long as you continue your subscription.

What is the difference between planned and actual performance?

What is the difference between planned and actual expenses?

A: Planned expenses are those that you know about ahead of time. Actual expenses are the ones you spend on something, after planning it.

Related Tags

- plan vs actual dashboard

- planned vs actual excel template

- plan vs actual graph

- plan vs actual production report

- planned vs actual percentage