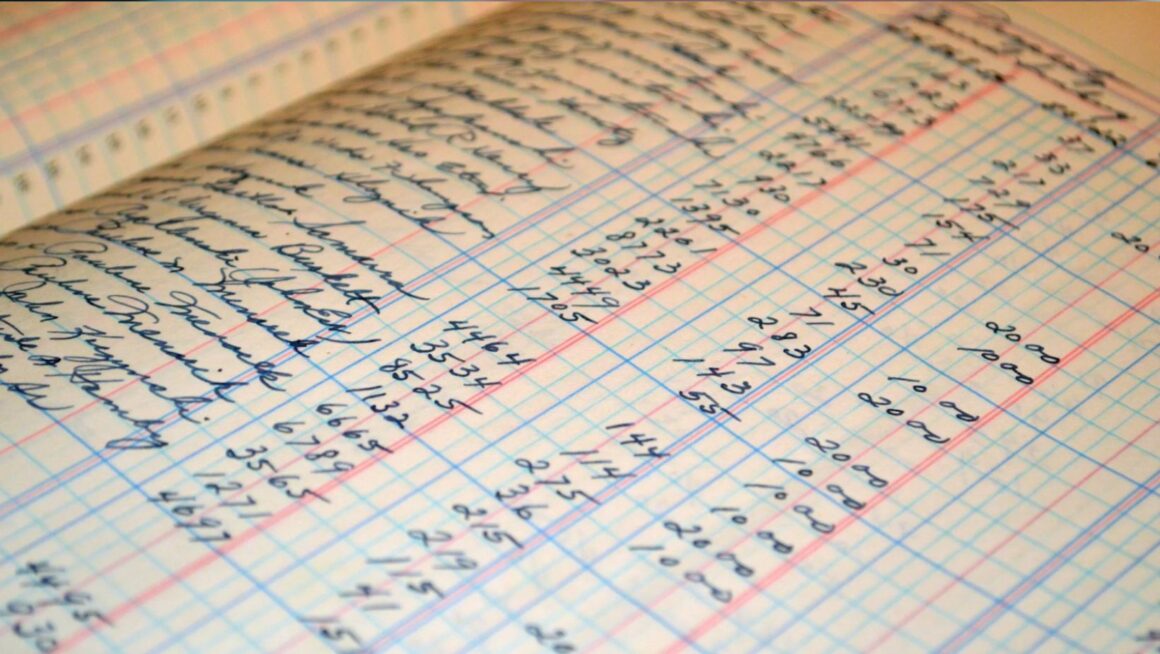

Proper bookkeeping is vital for any business, ensuring that financial records are accurate, up-to-date, and compliant with regulations. This integral function not only aids in tracking income and expenses but also plays a crucial role in fostering financial health. In an increasingly complex business landscape, companies must navigate diverse financial requirements while maintaining transparency and accountability. The significance of skilled bookkeeping extends beyond mere number crunching; it provides essential insights into business performance, assists in tax preparation, and helps mitigate risks associated with financial mismanagement.

Table of Contents

ToggleUnderstanding the Fundamentals of Bookkeeping

At its core, bookkeeping involves the systematic recording and organizing of financial transactions. This process encompasses various activities including tracking revenue, documenting expenses, managing accounts receivable, and overseeing accounts payable. Accurate bookkeeping provides a clear picture of a business’s financial position, enabling informed decision-making. Furthermore, bookkeeping involves categorizing transactions, which fosters better insights when reviewing financial statements. Utilizing software programs can streamline this process, reducing the manual workload and minimizing errors. Many businesses prefer hiring expert bookkeepers in Adelaide for instance, to ensure accuracy and compliance. Additionally, proper bookkeeping helps in managing cash flow, which is essential for maintaining operational stability.

The Importance of Accurate Financial Reporting

Accurate financial reporting is paramount for both internal and external stakeholders. For managers and business owners, these reports serve as tools for monitoring performance and making strategic decisions. Financial statements like balance sheets and income statements provide necessary insights into profits, losses, and overall financial health. Furthermore, external stakeholders, including investors and creditors, rely on financial reports to assess the viability of a business. Discrepancies in financial reporting can lead to a loss of trust and even legal complications, highlighting the necessity of accuracy in bookkeeping activities. Regular audits and consistent oversight can establish credibility and transparency in a company’s financial practices. Establishing effective communication channels between departments improves data integrity and ensures all financial information is timely.

Tax Compliance and Bookkeeping

Tax obligations are an unavoidable aspect of running a business, making diligent bookkeeping vital for compliance. Businesses are required to maintain detailed records of their financial transactions to substantiate claims made on tax returns. The internal revenue agencies demand accuracy and transparency, which can only be achieved through effective bookkeeping practices. Poorly maintained records can lead to audits, penalties, and even legal issues, emphasizing the importance of staying compliant with tax regulations.

Additionally, having organized financial data simplifies the preparation of tax returns, ensuring that businesses capitalize on available deductions and credits. Businesses can also strategize their tax payments more effectively when they have a clear view of their financial situation. Hiring professional bookkeeping services can alleviate the burden of tax compliance, as they are adept at navigating complex tax provisions.

Enhancing Cash Flow Management

Effective bookkeeping practices play a crucial role in cash flow management, which is essential for business sustainability. Accurate records of transactions help business owners monitor income and expenses, allowing for better forecasting and resource allocation. Tracking cash flow enables businesses to identify patterns in spending and revenues, freeing up resources for reinvestment. Furthermore, timely invoicing and collection of accounts receivable ensure that cash inflow is steady and predictable. Understanding the timing of cash flow can aid a company in making critical decisions, such as scheduling purchases or hiring new employees. A clear picture of cash flow also helps businesses prepare for unforeseen expenses, ensuring financial resilience.

Risk Management through Bookkeeping

Every business faces various financial risks, which effective bookkeeping can help mitigate. Poor financial practices can lead to cash flow issues, regulatory fines, and operational inefficiencies. By maintaining precise and organized records, businesses can identify risk factors early and develop strategies to address them. Evaluation of financial data allows for a better understanding of trends and potential vulnerabilities, helping businesses adapt to changes in market conditions. Furthermore, employing consistent bookkeeping processes enhances fraud detection and prevention. Regular audits and checks can disclose irregularities in financial records, fostering accountability and trust. Ensuring that only authorized personnel have access to sensitive financial data is another critical aspect of risk management.

Choosing the Right Bookkeeping Services

When it comes to selecting bookkeeping services, businesses should consider several factors to ensure they choose the right partner. First and foremost, assess the service provider’s expertise and track record in the industry. Understanding the specific needs of your business is essential, as one size does not fit all. Services may range from basic bookkeeping to comprehensive financial management solutions. Furthermore, evaluating the technology and tools utilized by the bookkeeping service can indicate their commitment to efficiency and accuracy. Transparency in pricing structures is also vital, as hidden fees can become a hurdle rather than a support. Additionally, seek references or testimonials from other clients to gauge the service quality. An effective bookkeeping partner should provide clear communication and be responsive to your inquiries.

Bookkeeping is a fundamental aspect of any business that cannot be overlooked. Its role extends far beyond basic number tracking, encompassing essential functions that uphold financial health and compliance. Accurate financial reporting, tax compliance, cash flow management, and risk mitigation are all intertwined with effective bookkeeping practices. By investing in skilled bookkeeping, businesses gain valuable insights and foster stability, paving the way for future growth.