Table of Contents

Toggle In the world of finance and business management, understanding the movement of money is crucial. That’s where a cash flow diagram comes into play. It’s a visual tool that illustrates the inflow and outflow of cash within a business over a specific period. This powerful diagram helps managers, investors, and financial analysts visualize financial data in a way that’s easy to understand and actionable.

In the world of finance and business management, understanding the movement of money is crucial. That’s where a cash flow diagram comes into play. It’s a visual tool that illustrates the inflow and outflow of cash within a business over a specific period. This powerful diagram helps managers, investors, and financial analysts visualize financial data in a way that’s easy to understand and actionable.

By breaking down complex financial concepts into simple visual representations, cash flow diagrams provide a clear snapshot of a company’s financial health.

Cash Flow Diagram

What Is a Cash Flow Diagram?

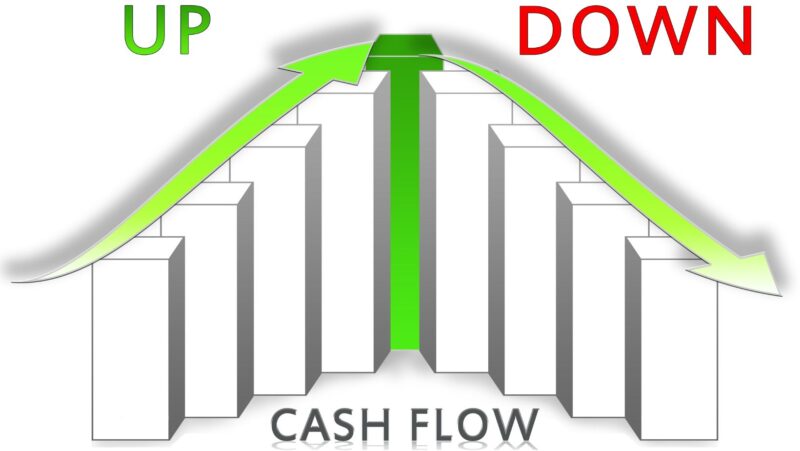

A cash flow diagram represents the inflows and outflows of cash for a business or project over a specific time period. These graphical tools plot cash movements on a timeline, showing deposits or income as upward arrows and withdrawals or expenses as downward arrows. The simplicity of a cash flow diagram lies in its visual nature, allowing individuals to quickly ascertain the financial dynamics at play without delving into complex datasets. Its value extends to various applications, from individual financial planning to corporate finance, serving as a foundational tool for understanding and managing finances effectively.

A cash flow diagram represents the inflows and outflows of cash for a business or project over a specific time period. These graphical tools plot cash movements on a timeline, showing deposits or income as upward arrows and withdrawals or expenses as downward arrows. The simplicity of a cash flow diagram lies in its visual nature, allowing individuals to quickly ascertain the financial dynamics at play without delving into complex datasets. Its value extends to various applications, from individual financial planning to corporate finance, serving as a foundational tool for understanding and managing finances effectively.

Importance of Cash Flow Diagrams in Financial Planning

In financial planning, cash flow diagrams are indispensable for several reasons. First, they offer a visual summary of cash movements, making it easier to identify periods of positive or negative cash flow. This information proves crucial for timing investments, debt repayment, and other financial decisions. Additionally, cash flow diagrams facilitate the comparison of different financial scenarios, enabling planners to project the long-term impacts of decisions made today. Businesses rely on these diagrams to strategize on maintaining liquidity, budgeting for future expenses, and optimizing their investment portfolios. By transforming abstract financial data into a tangible and comprehensible format, cash flow diagrams empower individuals and businesses alike to make informed financial decisions, ensuring sustainable growth and financial stability over time.

In financial planning, cash flow diagrams are indispensable for several reasons. First, they offer a visual summary of cash movements, making it easier to identify periods of positive or negative cash flow. This information proves crucial for timing investments, debt repayment, and other financial decisions. Additionally, cash flow diagrams facilitate the comparison of different financial scenarios, enabling planners to project the long-term impacts of decisions made today. Businesses rely on these diagrams to strategize on maintaining liquidity, budgeting for future expenses, and optimizing their investment portfolios. By transforming abstract financial data into a tangible and comprehensible format, cash flow diagrams empower individuals and businesses alike to make informed financial decisions, ensuring sustainable growth and financial stability over time.

Key Components of a Cash Flow Diagram

Time Scale

The time scale is a crucial component of a cash flow diagram, providing a framework to understand the timing of cash inflows and outflows. It divides the diagram into equal intervals, such as months, quarters, or years, depending on the scope and detail required for analysis. Accurate representation on the time scale ensures stakeholders can pinpoint when cash movements occur, facilitating better financial planning and decision-making.

The time scale is a crucial component of a cash flow diagram, providing a framework to understand the timing of cash inflows and outflows. It divides the diagram into equal intervals, such as months, quarters, or years, depending on the scope and detail required for analysis. Accurate representation on the time scale ensures stakeholders can pinpoint when cash movements occur, facilitating better financial planning and decision-making.

Cash Inflows and Outflows

Identifying cash inflows and outflows stands at the core of constructing a cash flow diagram. Inflows represent all sources of incoming cash, including sales revenue, investments, and loans. Outflows, conversely, encompass expenses, purchase of assets, and repayments of debt. Plotting these items clearly on a cash flow diagram helps in visualizing the financial dynamics, allowing stakeholders to assess the sources and uses of cash within a given period. This visualization aids in identifying periods of cash surplus or deficit, crucial for managing operational and investment activities effectively.

Identifying cash inflows and outflows stands at the core of constructing a cash flow diagram. Inflows represent all sources of incoming cash, including sales revenue, investments, and loans. Outflows, conversely, encompass expenses, purchase of assets, and repayments of debt. Plotting these items clearly on a cash flow diagram helps in visualizing the financial dynamics, allowing stakeholders to assess the sources and uses of cash within a given period. This visualization aids in identifying periods of cash surplus or deficit, crucial for managing operational and investment activities effectively.

Net Cash Flow

Net cash flow, the difference between cash inflows and outflows during a specified period, determines the financial health of a project or business. On a cash flow diagram, it’s visually represented by the distance between inflows and outflows over the time scale. Positive net cash flow indicates periods where cash inflows exceed outflows, signaling financial strength. Conversely, negative net cash flow highlights periods where expenses overshadow revenue, necessitating careful financial review and adjustments. Monitoring net cash flow through a cash flow diagram empowers stakeholders to make informed decisions to optimize financial performance.

Net cash flow, the difference between cash inflows and outflows during a specified period, determines the financial health of a project or business. On a cash flow diagram, it’s visually represented by the distance between inflows and outflows over the time scale. Positive net cash flow indicates periods where cash inflows exceed outflows, signaling financial strength. Conversely, negative net cash flow highlights periods where expenses overshadow revenue, necessitating careful financial review and adjustments. Monitoring net cash flow through a cash flow diagram empowers stakeholders to make informed decisions to optimize financial performance.